Transform Credit Data into Business Advantage

Fast and compliant financial decisioning through our all-in-one credit data as a service.

Fintech

Business Lending

Tenant Screening

Consumer Lending

Credit API Solutions for Every Industry

Equifax, Experian, and TransUnion credit reports, plus public records and alternative data – all in one place. Hassle-free lending, screening, and credit monitoring starts here.

Get the Best Data Solution for Your Business

Credit data is not one-size-fits all. CRS helps navigate the sea of data products to deliver cost-efficient, scalable, compliant data solutions that fit like a glove. Why settle for less? Get the right data for your needs.

Why We’re the Fastest CRA in the Market

Start pulling credit data in less than 2 weeks with an all-in-one credit data API integration set up in days. One contract, one vetting process, and fully-managed compliance makes working with credit data a breeze.

Designed for Developers

The #1 Independent Credit Data API

The fastest way to integrate credit and regulated data into platforms and processes is with an API that’s tailored to your language and framework. Our independent API is secure, redundant, and scalable. Responses are clean and clear. Save time with the new credit industry API standard, only with CRS.

Ruby

Python

JavaScript

Java

NodeJS

Go

PHP

NET

cURL

Credit Profile Request example:

curl --location --request POST 'https://api-sandbox.stitchcredit.com:443/api/experian/credit-profile/credit-report/basic' \

--header 'Content-Type: application/json' \

--header 'Accept: *' \

--header 'Authorization: Bearer eyJhbGciOiJIUzUxMiJ9.eyJzdWIiOiJkNzdjOWYzNS0yYTE1LTQ2YTMtYmIzNy05N2U0MGU3YWY0YmQiLCJpYXQiOjE2NjMyNjA5MjYsImV4cCI6MTY2MzI2MTgyNn0.Xxh5n8KX_zIMhXkEj1c8iqCBVm87ExuDu5u9wUMYT9W5VLTqQ8ThA8zM_Eormn662cO-nbF6UpVtCeNWYKgSmn' \

--data-raw '{

"lastName": "YCSWL",

"middleName": "",

"firstName": "ASAD",

"state": "CA",

"ssn": "666455730",

"street1": "9817 LOOP BLVD",

"street2": "APT G",

"city": "CALIFORNIA CITY",

"zip": "935051352"

}'

JSON

XML

HTML5

Credit Profile Response example:

"consumerIdentity": {

"dob": {

"day": "20",

"month": "02",

"year": "1982"

},

"name": [

{

"firstName": "ASAD",

"surname": "YCSWL"

"type": "A"

"employmentInformation": [

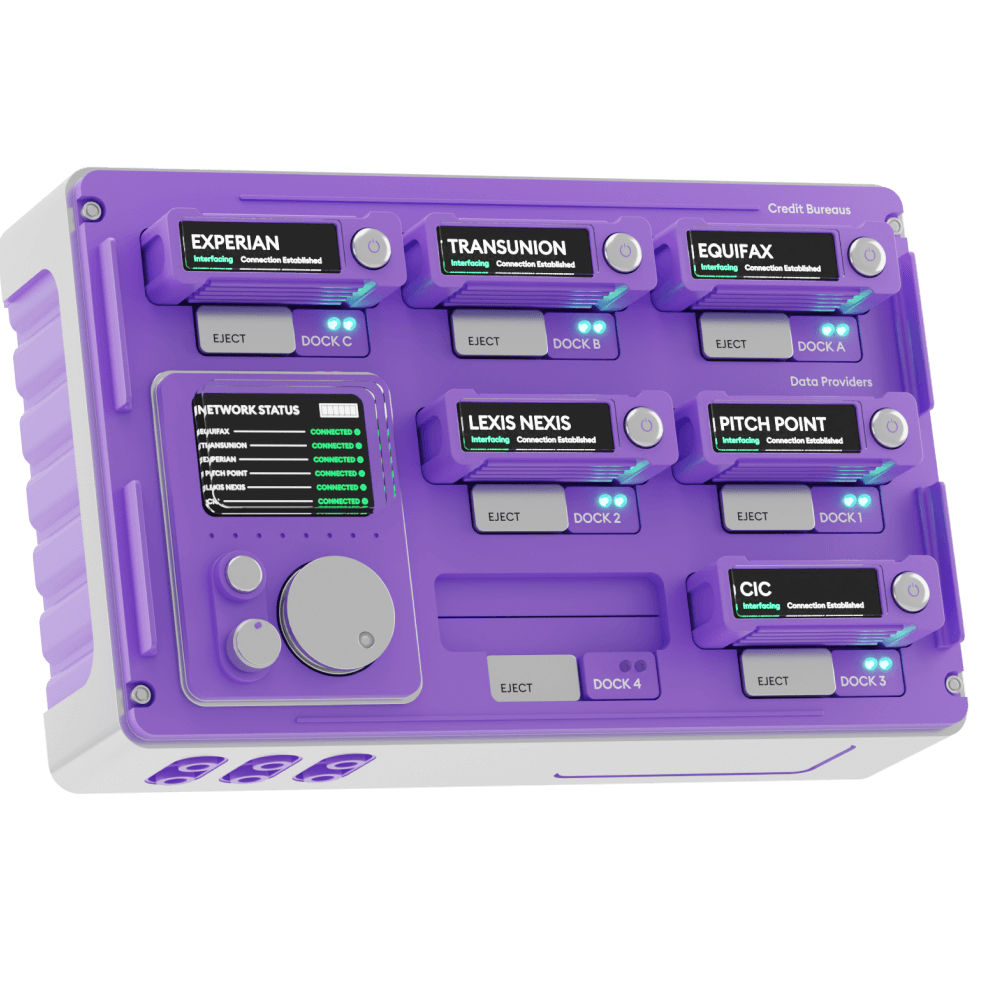

Tap Into the Leading Credit Data Ecosystem

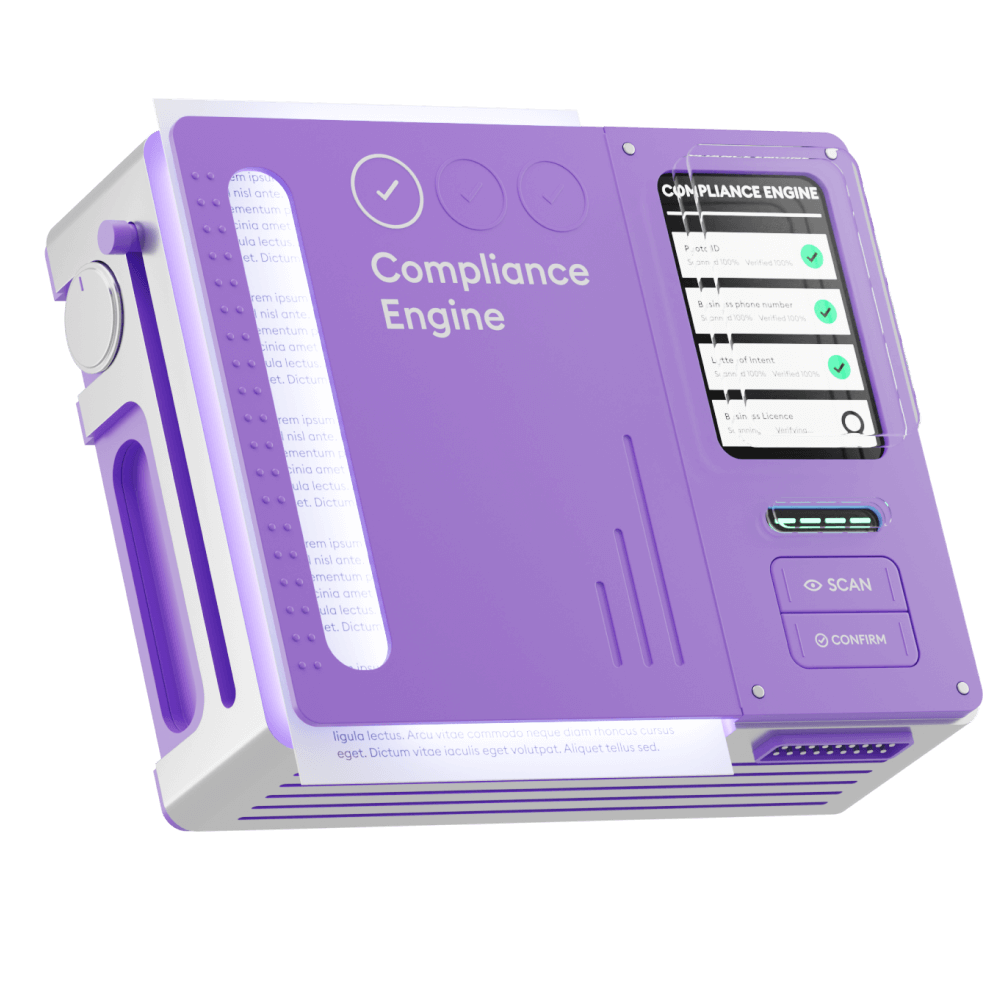

We hold the keys to unlimited, regulated data from credit bureaus and alternative data providers. We are a tech-forward Credit Reporting Agency with easy-to-use API integrations and a guided compliance platform.